Welcome to our first biweekly biotech deep dive, where we seek to give you a 360° view for a specific company. In this series, we turn our due diligence notes into more complete reports tailored for biotech investors, so compared to our monthly write ups, they are much more technical in nature. If you are just starting out or on the bio-sidelines, we recommend sitting this one out.

The Parallax View:

PI3K pathway inhibitors as a class are proven to have anti-tumor potency, but their biggest issue has always been safety. The PI3K class is huge with four isoforms, and they are across different stages of development: 4 drugs for PI3K-α (alpha), 4 for PI3K-β (beta), 11 for PI3K-δ (delta), 2 for PI3K-γ (gamma), and various other pan/dual/indirect PI3K inhibitors.1

While five PI3Ks are already approved to treat various cancers, many in development have failed clinical trials due to safety and tolerability issues. However, there is only 1 pure PI3K-γ inhibitor in clinic (defined as not being a dual or pan inhibitor), which we believe has clinical and competitive advantages over the other PI3K-inhibitors.

This PI3K company, Infinity Pharmaceuticals, stands out as its drugs appear to be (1) incredibly combo-ready and friendly, (2) has somewhat promising preclinical results, and (3) is a unique differentiated in-clinic PI3K player.

Potential for buyout by a PD-1 manufacturer is high if clinical success in combo trials is proven, but at this time we find the clinical results to be insufficient for a large position and prefer to wait to see what $INFI can come up with as more patients are treated in melanoma, RCC (renal cell carcinoma), and TNBC (triple negative breast cancer) and more efficacy is reported.

We consider Infinity, currently a micro-cap at ~$270M, to be a wait-and-see play into the high-risk July 27th catalyst event (+233%/-60%), where upon validated science we intend to greatly increase our initial position.

At a glance:

The $INFI Elevator pitch: Eganelisib is an oral, macrophage reprogramming therapeutic candidate; it is the only PI3K-γ in clinical development.

Keywords: PI3K-γ (gamma), macrophage

Upcoming Catalysts:

Date 1: July 27th readout – TNBC cohort data update (safety & efficacy) at a double n-count of n=26 (compared to the December 2020 readout)

Date 2: Further efficacy and maintenance of response results in December

Date 3: 1H 2022 renal cell carcinoma readout

101 Explanation:

“These are not the droids you’re looking for!”

When the body is growing, the immune system has several signaling pathways to let its defensive sentries know that cells are supposed to be growing rapidly and should be left alive. Cancer hijacks these pathways to fool the immune system into ignoring rapid growth, and over time these signals groom a population of immune cells to surround the tumor to tell any new immune cells that might pass by that everything is normal, a lot like the way that Obi-wan uses Jedi mind tricks to fool witless storm troopers into waving Luke and his stolen Deathstar plans through their security checkpoint.

INFI’s molecule seeks to dismantle cancer’s ruse, overtime training the immune cells that live near cancer cells to sound the alarm, recruiting the immune system to recognize the growing cancer cells as foreign invaders here to destroy our mighty space station.

201 Explanation:

Eganelisib reprograms macrophages to turn the greater tumor micro-environment from immune suppressed to immune activated. It does this by inhibiting PI3K-gamma, by turning pro-tumor M2 MDSCs into anti-tumor M1s, which proliferates T-cells. This then leads to interferon-gamma up regulation of PD-L1.

301 Explanation:

See below science section. It’ll tickle your fancy.

Company Pipeline & Trials:

Strategy & Management

What to know: We believe this company has oriented itself for acquisition given its sole drug, eganelisib, which we believe is both first and best-in-class if we rule out dual PI3K inhibitors (covering 2+ isoforms). We believe that the upside is incredibly high, as while both δ and γ inhibitors have been targeting and approved in the hematologic space, preclinical evidence suggest that these inhibitors have promising potentials in solid tumors as well, thereby opening up the total addressable market to $200B+ (in comparison, currently the 2027 total addressable markets for urothelial cancer stands only at $5.4B, TNBC at ~$0.8B, and head & neck at $2.3B). This advantage for Infinity is further amplified in that it is the only pure PI3K-γ inhibitor in clinic (with none on the market), where a premium would have to be paid for its rare asset. That being said, upcoming trial results will determine the size and quality of future partnerships with eganelisib.

Strategy:

We felt that the CEO Adelene Perkins knows how to generate and preserve company value based off our listening to conference calls. One highlight was when she stated in 1H 2021 that two kinds of companies have demonstrated interest in $INFI – those that are “leaders of checkpoint inhibition who need to defend their positions” and “companies not on the forefront asking how they can leapfrog to a leadership position.” This suggests $INFI is obviously in close contact with big pharma with sizeable CPI (checkpoint inhibitor) capabilities as well as smaller biotechs who like exposure to INFI’s potentially efficacious drugs for future combination trials.

Eganelisib is relatively safer compared to other PI3K drugs in-clinic and on the market. There were 130 patients dossed across 6 different tumor types with relatively good tolerance. Management has also repeatedly stated eganelisib’s safety profile as a competitive advantage.

BMS, Genetech, Arcus are all partners in trials, and if eganelisib shows promising combination results, then there is a strong case to be made for acquisition, suggesting that there is a strong alternative for PD-1 double-combo therapies in urothelial and TNBC.

Competitors:

Simply put, $INFI’s eganelisib is the only pure PI3K-γ drug in clinic, and there is also no pure PI3K-γ in market. That being said, there are two indirect dual-PI3K γ/δ competitors.

AstraZeneca ($AZN):

A pure PI3K-γ inhibitor (AZD3458) which is yet to enter clinic

A dual PI3K-γ and -δ inhibitor (AZD8154) that is on hold

Rhizen Pharma (private):

A dual PI3K-γ and -δ inhibitor Tenalisib (RP6530)

There are also only five clinically approved PI3K inhibitors, none of which is a pure PI3K-γ inhibitor and competes directly with $INFI’s eganelisib:

Alpelisib by Norvartis (-α inhibitor)

Idelaisib by Gilead (-δ inhibitor)

Umbralisib by TG Therapeutics (-δ inhibitor)

Duvelisib by Secura (by way of VSTM, which purchased rights from INFI, dual -γ/-δ inhibitor)

Copanlisib by Bayer (pan inhibitor)

Is Duvelisib (PI3K-γ/δ) a threat?

It should be noted that Duvelisib is a dual PI3K-γ & δ inhibitor (not pure). In terms of its profile, Duvelisib is not the most promising drug as it carries a noticeable black box warning due to the risk of potentially fatal or serious toxicities such as infections, diarrhea, cutaneous reactions, and pneumonitis. It also failed to meet its primary end point in allergic asthma and in rheumatoid arthritis. More importantly, it’s been kicked around as an asset, first from INFI to VSTM, and now to Secura Bio. This suggests that companies have not seen traction and/or its efficacy to be too promising and would rather have another party hold onto the asset. More importantly, INFI retains full rights to its pure PI3K-γ asset, and it could be surmised that it offloaded Duvelisib (IPI-145) to VSTM given its pessimistic outlook on the drug.

Other Observations:

INFI partnering heavily and doing combination trials will require that it meet its endpoints in order to demonstrate that it has meaningful value

It is currently engaging in mono, combo, and triplet therapies

INFI mentioned the positive relation between PD-L1 expression positivity rate and the ORR for anti–PD-(L)1 therapy, but it didn’t show any p-value or r^2 that we could find. We raise this a yellow flag.

In 2018, $INFI provided a median pay of $495,513, which was the highest-ranking pharma or biotech company on the Boston Business Journals compiled list of the 25 US companies with the highest median salary. We raise this as a red flag given the higher burn rate and possible skewed implications for incentives, employee motivations, and longer avg. tenure at the firm (vs. stock option compensation)

CEO, LinkedIn, Hiring:

Adelene Perkins (CEO): HBS + Ex-Bain (7 years) and joined INFI since 2002, becoming CEO in 2009. Hasn’t sold many shares recently and has many options. Very able at articulating implications of science for business based on the many conference calls we’ve listened to

Company headcount & average Tenure: close to 70 employees with 8 year avg. tenure — people tend to stick around and might be enjoying their high salaries, which we find a potential net negative

Science Review

We find that Infinity is very upfront with their publications and scientific approach. They are published in the right papers, and more importantly looking at an immunological target and pathway that is still the focus of a lot of attention. The PI3K-gamma pathway is theoretically a compelling “master off switch” for the mTOR cell proliferation signaling cascade that enables immunotherapy resistance under proven monotherapies such as anti-PD-1, MEK inhibitors, or TKIs, but the PI3K inhibitor arms race has yet to turn out a small molecule inhibitor that is effective enough to be worth the tolerability troubles.

Drug 1: Eganelisib (IPI-549)

Indication targeted: RCC, TNBC, Head & Neck, other solid tumors (P1)

Brief explanation of mechanism: small molecule inhibitor prevents PI3K- 𝛾 activation which upregulates pro-tumor macrophages and myeloid cells

Differentiating factor from competitors: selective to PI3K- 𝛾, upstream target vs. other mTOR approaches to circumvent potential compensatory signaling cascades

Clinical Results: First line breast combo (PD-1+paclitaxel) had 100% OR n=4 – hard to interpret as OR for the combo of PD-1 and paclitaxel is ~50%2

For the melanoma cohort they had OR of 10%, 20% for pts with only 2L failure (vs. 3L+) . Results are not particularly compelling in any indication, which is why we prefer to wait-and-see for July 27’s catalyst event

Chance of Success: 20%. There are lots of headwinds to move from successful theory to successful drug here and will need large n-count P3 studies to validate how much benefit is conferred for (1) adding to 1L combos (probably the best commercial outcome) or (2) re-treating with PD-1 after drug resistance in prior line) – which is going to be a harder needle to thread

Insights & Takeaways:

Advantages of PI3K-γ, based off secondary scientific literature reviews, suggest that they play a more crucial role in myeloid cells relative to other classes.Inhibition of PI3Kγ also has a higher suppressive impact on macrophages than the inhibition of delta δ

Eganelisib can show 100x selectivity for PI3K-𝛾 over other PI3K isoforms

While both δ and γ inhibitors have been targeting and approved in the hematologic space, preclinical evidence suggest that these inhibitors has promising potentials in solid tumors as well, thereby opening up the total addressable market to $200B+.

M2 macrophages and Myeloid Derived Suppressor Cells (MDSC) are believed to be “pro-tumor” cells that propagate near solid tumor cells and prevent T-cells from recognizing and destroying cancer

Belief that if these cells can be deactivated (or more accurately if their populations can be deregulated in favor of M1 macrophages) it will increase effectiveness of immune response and immunotherapies – particularly anti-PD-1 agents as the suppressor cells are linked to lower rates of PDL-1, it’s ligand. As a result, this is a combo-therapy play to boost proven immunotherapy agents, currently partnered with the anti-PD-1 drugs and chemotherapy agents

Small molecule inhibitor IPI-549 targets PI3K- 𝛾 enzyme activation site with 100-fold specificity for the gamma isoform implicated in cancer. Believed to be activated in all cancer types though more associated with hematopoietic system in healthy cells, so potential for solid and liquid tumor label expansion if there is success in combo trials. Could also be repurposed as anti-inflammatory for cardioprotective benefits if tolerable (which it doesn’t seem to be)

Unfortunately, trial results to-date have been lackluster and will crucially depend on the July 27th readout. INFI is trying to sell this molecule as something to add to proven 1L treatments like paclitaxel and anti-PD-1 agents, but not sure the data suggests there is a great benefit here. The other track they are taking is to re-attempt prior lines that had response but became drug resistant. They have a few patients who have had success under this approach, but it’s typically 10-20% of those cohorts and there isn’t a ton of data either. Safety is not great (20-50% Grade 3+, higher rates with chemotherapy) given it’s a small molecule inhibitor and these immune cells are active throughout the body. We would not recommend their trials to a loved one based on this data, and would wait until there are larger n studies completed

💡Key science points we’re thinking about💡

Why is PI3K- 𝛾 superior to PI3K-δ/-𝛾 found in Duvelisib other than better clinical performance?

Current scientific theory is a little half-baked from what we can tell, thinking is that blocking all parallel cascades via the class IA PI3K inhibition could lead to greater compensatory feedback, rather than being the type of sparkle on top signal that could turn the tide from suppressive to inflammatory macrophage activity – however not much data examining differences head-to-head in mouse models, so we are left with clinical trials of drug candidates

Blocking multiple PI3Ks also leads to poorer tolerability – previous molecule they bought and sold (and many other multi- and pan-PI3K targets) during P3 trial had high AE rates despite high objective response rates and very high lymph node response rates – in fact early trial data from this inhibitor looks better than IPI-549.

Could just be selectivity for the PI3K- itself – a better performing molecule, but this ultimately becomes a poor argument for why it will be game changing when there is already a mildly effective inhibitor approved

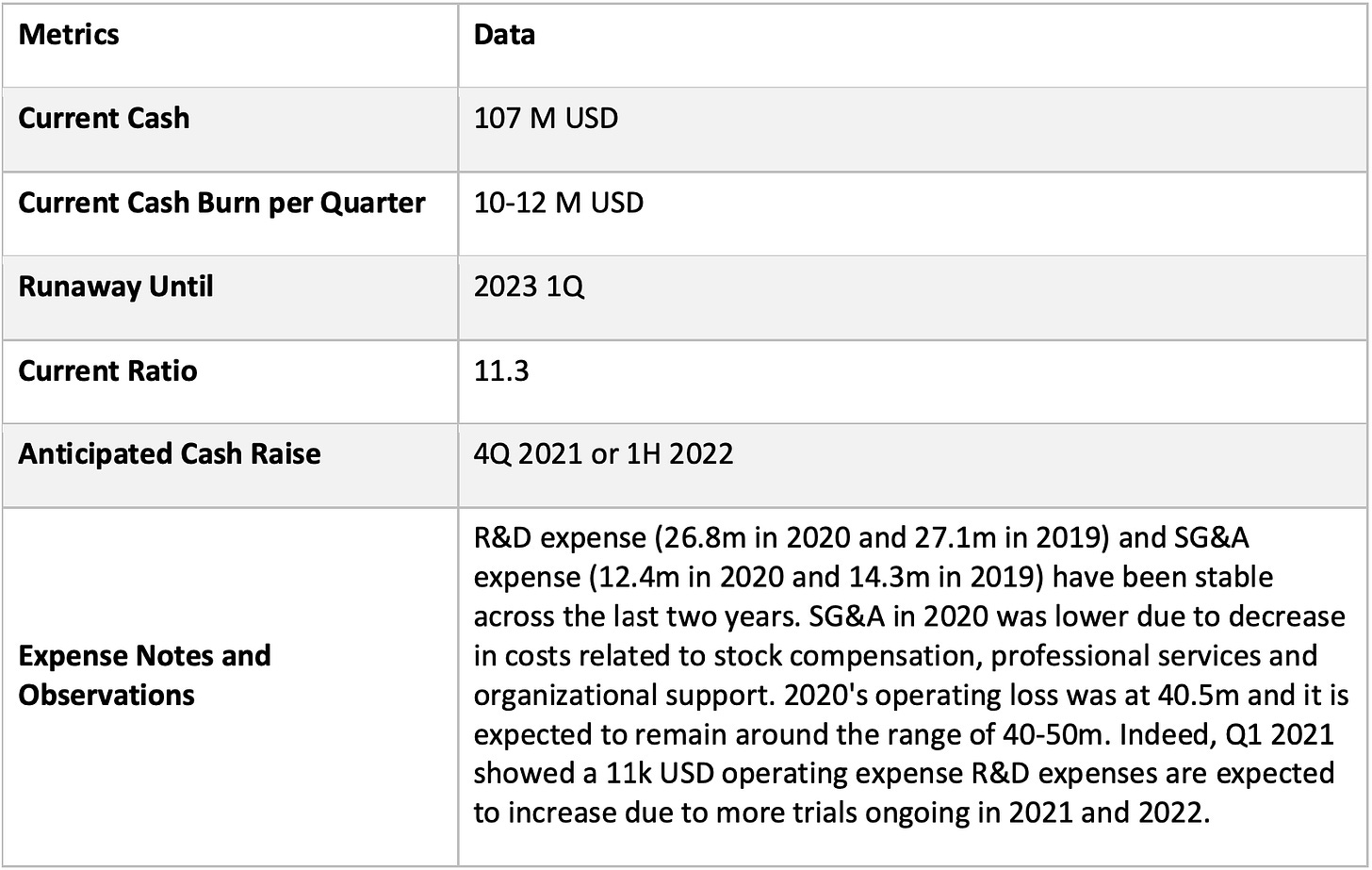

Financial Health

The company recently closed an offering in February and received proceeds of ~$92 mil (after exercising over-allotment options), positioning them well to run through their phase 2 trials across its MARIOs. This should allow them to operate till at least 1H 2023.

INFI sold the development and commercialization rights of another drug Copiktra to Verastem, which then sold it to SecuraBio and in exchange will receive % of net sales. Thus, revenue is projected to remain at a small amount around 1m-2m in the next year so it’s pretty much negligible. INFI may also receive 5m from BVF based on its patidegib Phase 3 data from Pellepharm.

Given the cash burn, we believe INFI to be a hold until at least July and 4Q 2021 for MARIO-3 results on triple negative breast cancer. Watch out for potential dilution in 4Q 2021, as if the results are extremely impressive, INFI may want to raise more cash early if they are really confident in their future phase 3 approval and commercialization.

Institutional Ownership in descending ownership percentage:

Biotechnology Value Fund (9.5%)

Consonance Capital Management (7.4%)

Vanguard (4.0%)

Millenium (3.6%)

Blackrock (2.3%)

Price Targets:

$12 - Truist

$4 - Wells Fargo

$9 - Oppenheimer

$7 - Piper Sandler

$7 - B. Riley

Average: $7.8

We note that Robyn Karnauskas of Truist also happens to be one of the rare analysts that was right re: June’s Biogen FDA decision.

Disclaimer: Biotech investing is inherently risky. Our post is for informational purposes only, published to the best of our knowledge and understanding. We accept no liability for any potential direct or indirect losses as a result of our research and views. The reader bears full responsibility for their investment decisions. We reserve every right to adjust our positions without notice.

Enjoyed this? Subscribe for company-specific deep dives. Or give it a share.

Gems and Links:

White papers and articles:

IPI549 Drug Design:

Trial Links

https://cancerres.aacrjournals.org/content/81/4_Supplement/PS11-32

https://investors.infi.com/static-files/af9d5c55-e240-4e63-902c-50955097846d

https://investors.infi.com/static-files/14fa0e1e-090b-4881-bdcb-627d96361a44

https://doi.org/10.1038/s41573-021-00209-1 Nature Review 2021

https://tcr.amegroups.com/article/view/39957/html (thanks to @Traderix2 for pointing it out)

So what did you think of the July 27th results?