Huge h/t to @paras_biotech & @LifeSciVC for the charts & figures below

1. The sector was flooded with IPOs in the past two years, over half of which were very nascent & high-risk biotechs, and many of which were (pre-maturely) ushered to the markets by funds & VCs…

… which was first driven by a frenzy in private funding and valuations thanks to zero rates, inflation, and attention to the sector.

Source: youtube.com/watch?v=Es1wzWnED-g

2. As topline estimates for big pharma continue to darken due to many reasons (policy & price reform, thinner pipelines, global competition, IP, etc…)

… pharmas have also hoarded cash and appear eager to buy:

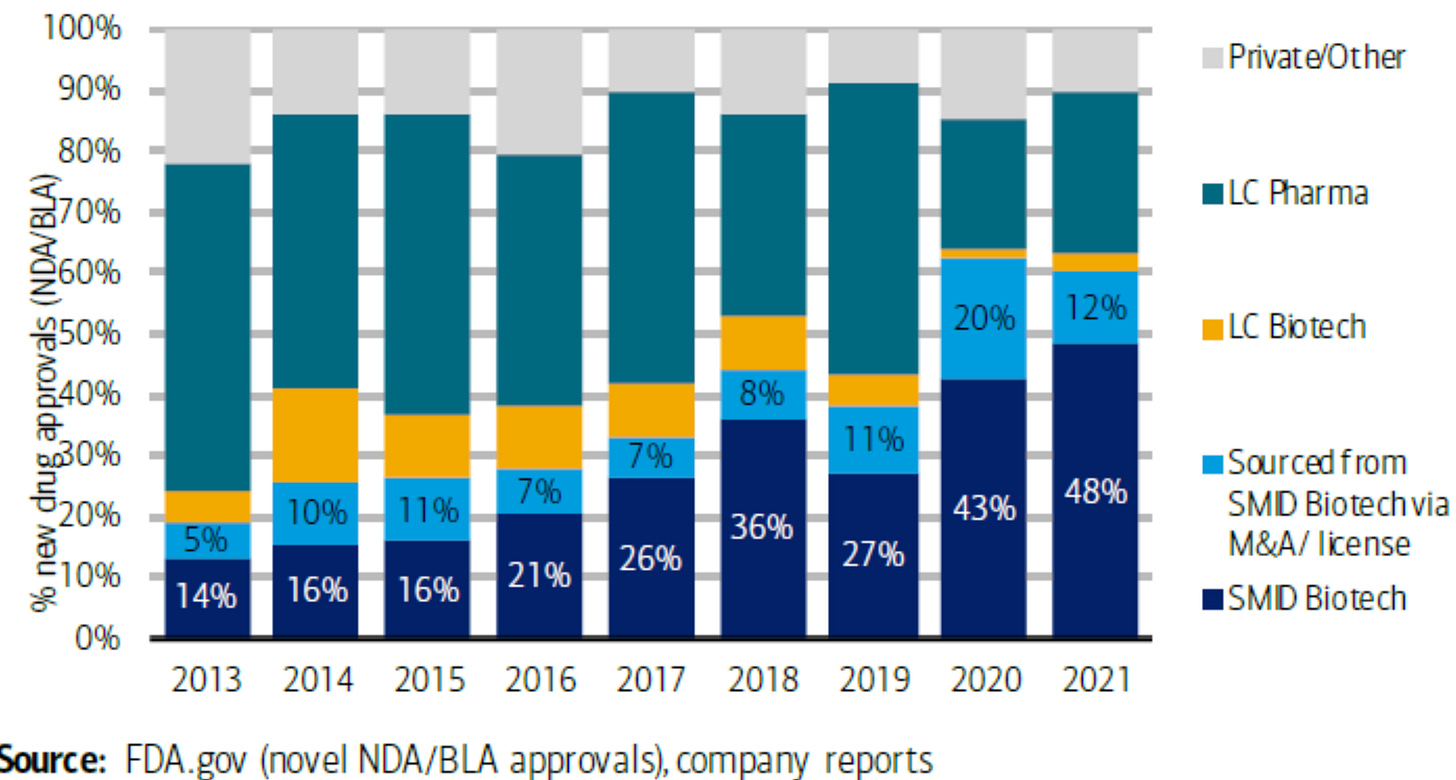

3. Yet as the burden of drug R&D and innovation is increasingly (and successfully) outsourced to small/mid-cap biotechs by pharmas…

… biotech buyouts almost feel like a thing of the past.

4. The $XBI is down almost 50% from its ATH exactly a year ago, where it finished -20% in 2021 and is yet again -20 to -25% YTD.

… and small-cap biotechs are beaten down even more relative to the Russell as investors move away from negative earners.

5. But at the end of the day by the end of the year, promising science and clinical results will do the talking…

… and meanwhile, balancing news flow, doing real research, surviving (cash burn & financing), and managing expectations will remain a very tough challenge in depressed sector conditions.

The handful of positive 2021 IPOs ; the majority are deep in the red.

The Parallax View

2022 will make or break many small & mid-cap biotechs; the pain for many will not end here ($XBI around ~$93 at the time of writing), especially if/when larger indices nosedive

Pent-up news flow from 2021’s relatively slower & quieter readouts will lift those with validated milestone clinical results and ruthlessly punish those in catalyst deserts - patience has run very thin in the sector

Pharmas have discounted prices to many potential targets, but this won’t change how they do their homework and due diligence on them - it will be just as rigorous, if not more, given all the competition. They can afford to (out)wait

It’s probably smarter to filter out all the too-nascent, too-risky biotechs, as the sector has been watered down with biotechs that will (1) eventually raise at low prices and (2) still have nothing to show

A reminder that M&A is far and few in between, and that companies with promising science & stories will separate themselves from the junk

And another reminder that even though biotechnology is an extremely young industry, we might very well be living in the ‘penicillin moment’ for cancer and many other diseases right now