Exclusive: $ARVN | Arvinas

Thank you for subscribing! Your support does not go unnoticed and we appreciate you as an early reader of our exclusive research.

Arvinas ($ARVN): The only protein degradation company in Phase 2 trials

Commentary

Arvinas is a clinical stage company developing heterobifunctional degraders for immuno-oncology. Arvinas is the most well established player in the space and their wholly owned pipeline is the most advanced. The main assets in their pipeline are ARV-110, a degrader of the androgen receptor being developed for mCRPC, and ARV-471, a degrader of the estrogen receptor being developed for ER+/HER2- Breast Cancer. ARVN is also working on several historically undruggable targets, namely KRAS G12D/V, Myc, and Tau, although all three are still in the very early research stage.

ARV-110 targets the androgen receptor which had been a clinically validated target for the prostate cancer. While several small molecule inhibitors of the androgen receptor are FDA approved, these inhibitors turn out to be ineffective for metastatic castration-resistant prostate cancer patients, thus requiring some other forms of treatment to tackle.

Both have entered phase II trials and interim clinical data has been presented demonstrating the safety and efficacy. ARV-471 had a clinical response rate of 42% for heavily pretreated patients and was well tolerated. Treatment of ARV-110 was shown to decrease the concentration of prostate specific antibody, a marker for prostate cancer, by >50% in 40% of patients with T878 or H875 mutations in the androgen receptor. Excitingly, based on the interim data from the two trials there does not seem to be evidence of modality specific adverse effects.

The androgen receptor is a clinically validated target for the treatment of prostate cancer. The androgen signaling pathway plays a key role in the pathogenesis of prostate cancer. While several small molecule inhibitors of the androgen receptor are FDA approved, mCRPC patients do not respond to treatment with these agents. Genomic analysis of mCRPC patients has not revealed an ideal target for development of a relevant checkpoint inhibitor. There are ~40,000 new mCRPC patients in USA each year. The prognosis for mCRPC is grim with a median survival of 2 to 3 years. The current standard of care is chemotherapy and usually extends the life of patients a few months. For these reasons mCRPC provides a meaningful test case for TPD technologies and the ability of AR-110 to address a challenging unmet need.

In ER+/HER2- Breast Cancer the ER receptor pathway is involved with the progression and development of the disease. Currently the standard of care includes selective estrogen receptor modulators and aromatase inhibitors, which attempt to block the proliferative effects of estrogen by either decreasing estrogen levels or blocking estrogen binding to the ER. Unfortunately, ~30% of patients will become resistant to treatment in 3-5 years and the disease progression will occur. While this represents an opportunity to use bifunctional degraders, monofunctional degraders known as selective estrogen receptor degraders have been used for the treatment of this disease for almost 20 years. Again another example of an accidental targeted protein degrader! Though this is a reasonable target and good test case for the technology and developing a bifunctional degraders will probably more easily allow for a next gen treatment, the need for AR-471 is not dire.

The most advanced parts of their pipeline are focused on redrugging the druggable, but they are focusing on targets where continued use of small molecule inhibitors commonly results in drug resistance. They have numerous projects at the preclinical stage that are targeting proteins that have been long thought of as undruggable, like transcription factors and scaffold proteins. There does seems to be a nascent neuroscience division that is focused on developing lead compounds for the treatment of tauopathies and alpha synuclein related diseases. In 2019, Arvinas published preclinical data relevant to their tauopathy project that demonstrated that a heterobifunctional degrader could be designed to penetrate blood brain barrier. While they did not disclose the how they accomplished this feat, it seems that they have developed techniques that will enable them to target proteins in the brain. (We are not overly bullish on this fact as others are).

Arvinas is focused on redrugging the druggable, but it is not fair to hold it against them since they were the first company to bring heterobifunctional degraders to the clinic and had to derisk in some way. We do not love their targets, but they are fine at the end of the day in capturing value. They seem like they play their cards close to their chest. Their description of their discovery platform is vague and can be summed up as: we use known techniques, our know-how and some proprietary chemical and DELs to design and synthesize drugs. Unlike the other players, they also wholly own their pipeline. It is hard to judge their technology, but we are convinced they know what they are doing and the company is solid.

Overview

1. Already validated targets within prostate and breast cancer. Validated targets mean there’s a higher chance of success in treatment and the test is more on efficacy in tumor shrinkage. Solidified science through 50/50 partnerships with Pfizer in July 2021 on ARV-471.

2. Strong linkage between Alzheimer’s Disease and Tau protein makes it a worthwhile investigation given the Biogen fanfare. Although still an in pre-clinical studies and development, if it can demonstrate significant reduction of tau protein in the brain, this could be a game changer for potentially first line patients showing symptoms of dementia and PROTAC may significantly delay cognitive decline of elderlies. We’re not reading too much into this.

3. Arvinas has a first mover advantage when it comes to the stage of its pipeline. Arvinas is definitely in the lead when it comes to using PROTAC, with its Phase 1 trials of both ARV-110 and ARV-470 demonstrating positive results. Especially in patients that have received multiple treatments, PROTAC still demonstrated meaningful improvements in certain patients. It sets the tone and validates the science behind it and translates to numerous possibilities for the area and other companies to thrive in.

4. A potentially effective treatment compared to others to wildtype AR is a bonus/unexpected findings for ARVN. While it would have been better for them to separate the population more, it is still pleasing to know that based on initial data there’s response to patients with AR mutations. The more effective to a more specific subset of population, the better the drug is because it’s addressing more unmet needs.

5. Drugs’ safety profiles showed high tolerability of protein degraders in current patients, and can encourage higher doses without compromising safety. We’re looking forward to see a higher dose of ARV-110 and ARV-471 in phase 2 data without compromising tolerability

ARV-471: an ER-targeting protein degrader for breast cancer, which was the cornerstone of the Pfizer-ARVN <$2.4B deal.

Science:

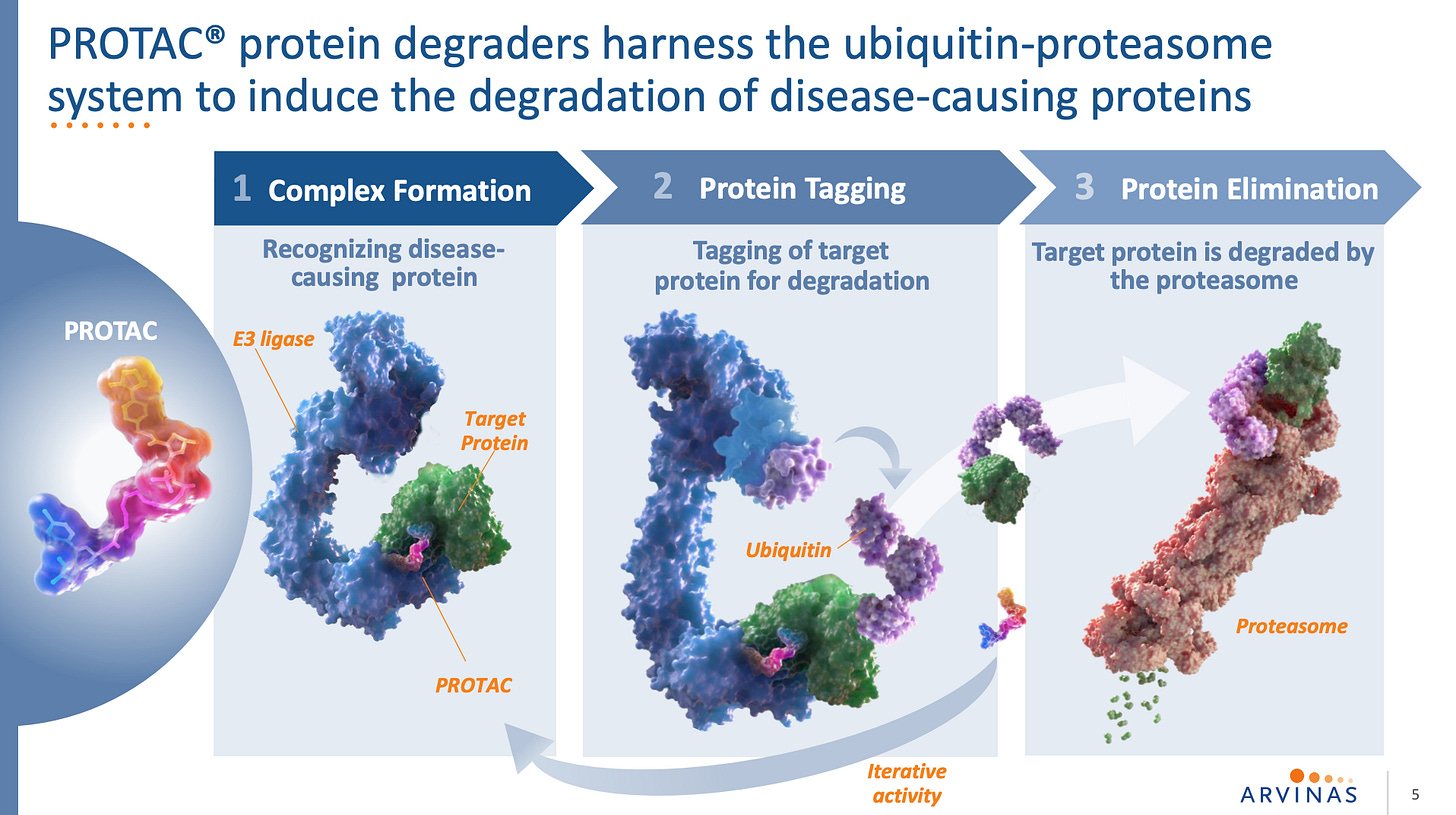

Arvinas has a pipeline of proteolysis targeting chimeras, or PROTAC protein degraders that are targeting three key areas: Androgen Receptor, Estrogen Receptors, and Neuroscience (e.g. Alzheimer’s, Parkinsons, Huntington’s). Arvinas also has its own proprietary PROTAC discovery engine and own knowledge base to identify the right E3 ligase and allow a quicker turnaround in designing PROTACs. It has established a partnership with Roche and Pfizer for target discovery deals, as well say as Bayer which also involves agricultural product drug discovery.

Arvinas owns the PROTAC trademark so here’s a slide paying homage to that.

Pipeline:

Majority of the pipeline is still in the exploratory/research phase so emphasis is on the ones listed in blue and green.

Phase 1/2 results:

ARV-471 Phase 1

Well tolerated with dosage up to 360 mg taken daily (only grade 1 & 2 adverse events reported) 62% mean ER reduction vs. 40-50% from fulverstrant. Confirmed partial response observed in 1 patient and tumor shrinkage in others.

ARV-110 Phase 1

4 out of 28 (14%) had PSA reductions of over 50%. 2 out of 5 Patients with T878/H875 mutations also experienced PSA reduction of over 50%.

Save the Date

ARV-471 interim CDK4/6i (Palbociclib) combination data 2H2021

ARV-471 (ER+ positive / HER2- negative breast cancer): Phase 1 dose escalation data to be presented 2H 2021. P2 dose expansion trial initiated

ARV-110 ARDENT Phase 2 interim data expected 2H 2021

ARV-110 (Castration-resistant prostate cancer (CRPC): Completion of Phase 1 dose escalation 1H 2021 with data to be presented 2H 2021.

Things to note

Founder of ARVN, Craig Crews (from Yale), was one of the inventors of targeted protein degradation – first published about PROTAC degraders in 2001. He’s currently sitting at company’s Scientific Advisory Board (ARVN). He also runs Halda therapeutics which we discussed in the TPD write-up, which may limit the ultimate scope of ARVN’s work

It’s the only firm that has initiated phase 2 trials

Developed orally bioavailable degraders

Degraders can cross blood-brain barrier in preclinical studies

Arvinas’ 2 latest drug candidates both the target the same E3 ligase cereblon

Things we like

Strategy

ARVN is trying hard to tackle the scientifically sound receptors related to the disease, i.e. AR and ER. Furthermore, they’re trying to show that protein degraders are effective on patients that are already resistant to previous treatments (in ER< 100% patients selected had already been pretreated on CDK4/6i, 71% of the patients had received fulversant (estrogen receptor antagonists (as prior treatment, median number of previous treatment was 5).

Currently ARV-471 is positioned to treat 2nd or 3rd line patients, but is also exploring opportunity to see efficacy in combination with CDK4/6i. Especially when protein degradation is still a very novel therapy, we think it’s worth exploring the power of protein degradation at different stages of breast cancer. Re: AR, ARVN is also focusing a subset of prostate cancer patients and have showed efficacy in treating that area as well.

Management

CEO worked extensively in the early discovery and development stage in a drug pipeline. He worked in BMS for over 18 years, focusing on early development which translates to more than 200 compounds under his oversight, as well as optimizing lead discovery. If anything, we would have expected the company to focus more on optimizing its discovery engine to maximize number of viable targets. But the PROTAC discovery engine as described on its website lacked a scientific, systematic and continuous process compared to its competitors.

CFO has been in Arvinas since 2014, has over 20 years in life sciences industry, previously was also CFO of Axerion Therapeutics for almost 4 years, and CuraGen for almost 2 years.

Craig Crews, who’s currently sitting in the scientific advisory board, and is one of the pioneers in the protein degradation field as well as the founder of Arvinas. Currently also a professor at Yale University, He has done major research in the area, and developed proteasome inhibitor Kyrprolis to treat multiple myeloma in early 200s

Financial health

The company has over 2 years of cash runway with minimal liabilities. Our calculations indicate <1.3B cash post-Pfizer with a current 47M cash burn rate which will definitely increase due to R&D. Greater partnerships with Pfizer, Genetech, and Bayer on different targets research.

Partnerships

Pfizer:

Summary: Arvinas and Pfizer to conduct separate research program on targets designated by Pfizer. Pfzier may exercise the option to obtain a worldwide license with respect to each target for a specified period of time.

July 2021: Global collaboration to develop and commercialize ARV-471. Profits and costs to be shared 50/50 worldwide

Amount of money :

July 2021: Arvin will receive a $650m upfront payment to co-develop and commercialize ARV-471. Profits and costs associated to ARV-471 to be 50/50. Also a $350m equity investment from Pfizer. Pfizer ownership is ~7% after the new equity investment.

December 2017: Upfront payment of $28 in 2018. Eligible to receive up to $37.5m if Pfizer exercises its options for all targets, 225m in development milestone paymentsand up to 550min sales-based milestone payments for all designated targets. Also eligible to receive mid to high single digit tiered royalties

Genetech:

Summary: Genetech can designate up to ten targets for further discovery and research utilizing Arvinas’ PROTAC platform technology

Amount of money : Upfront payment of $11m USD + 34.5M USD. Eligible to receive 44m per target subject to milestones, 52.5m per target subject to regulatory milestones, 60m per licensed PROTAC subject to specific sales milestones. Also subject to mid-single digit royalties on licensed PROTAC sales

Date: September 2015 and further amended in Nov 2017

Bayer:

Summary:

Arvinas and Bayer to conduct research programs on targets selected by Bayer. Also created a joint venture with to developer PROTAC for applications in the field of agriculture.

Amount of money: Upfront payment of $17.5m. Also eligible to receive up to $197.5m in development milestones and up to $490m in sales based for designated Targets. Eligible to receive, on net sales of PROTAC related products, mid-single digit to low-double digit tiered royalties. Bayer to fund $3m per year in each of the first four Research Program Years

Date: June 2019

Intellectual property

PROTAC platform patents:

2 issued U.S., 9 pending U.S. patents, 9 granted foreign and 80 pending foreign applications

Product specific:

15 U.S. issued patents, 26 issued foreign patents, 54 pending U.S. patent applications, and 193 pending foreign patent applications

Who’s with us?

Largest ownership by percentage: Fidelity Investment 8.7%, Canaan IX 7.3%, Blackrock, 6.1%, Vanguard 5.2%, Price T. Rowe 4.9%, New Leaf Venture 4.7, J.P. Morgan 3.5%, Point72 2.3%, 5AM 1%

Price targets:

UBS: $123

Truist: $150

BMO: $101

Cantor: $140

Oppenheimer: $100

Piper: $97

Citi: $123

HC Wainwright: $100

Roth: $120

Recommended way to invest:

ARVN is 90% held by institutions, 12% by insiders, and has a float % of 85% (out of 49M shares outstanding)

ARVN’s got a nice boost in terms of stock price due to the ARVN deal. We believe that the stock will cool down for a bit and to see overall sentiment to see where there’s support at 95-100$ level (issuance of new shares to Pfizer priced at a 30% premium of July 2020 share prices would be around 100)

We believe ARVN to be a long-term hold beyond the ARV-110 and ARV-471 readouts in 2H 2021, and thereby look to incrementally accumulate shares of ARVN at each major pullback over the next year