After a few requests, we are making this TPD article free out of the 4 posted. We also provide a rapid turnaround due diligence service for those interested. You can find this newsletter at www.parallax.bio and follow us on Twitter.

C4 Therapeutics ($CCCC): Playing it safe and focusing on speed-to-market & yesterday’s targets

Commentary

C4 is a preclinical biotech focused solely on oncology with a ~$1.9B market cap. Their pipeline consists of a mixture of monofunctional and bifunctional degraders and they have 4 undisclosed wholly owned programs in discovery and 9 undisclosed collaborator programs in discovery.

C4 appears to be more explicitly focused on enhancing the catalytic activity of their degraders in an attempt to more efficiently degrade the protein of interest, which is not something we have seen their competitors discuss. This focus on catalytic efficiency makes us believe that they have a good handle on optimizing cell permeating ability and predicting pharmacokinetics and pharmacodynamics. Based on their preclinical data it seems like this approach is working well for them.

C4 developed a tool called aTAG to allow them to understand how degradation of their protein of interest affects the cell. The aTAG small protein can be connected to a protein of interest (POI). The bifunctional degrader of aTAG is known and can be used to degrade the aTAG-POI fusion. We find this tool powerful in that can provide researchers with a quick and direct method to study the consequences of degradation of the POI in in vivo models.

C4 also has a discovery platform called TORPEDO that sounds like it is composed of in silico software, drugs libraries, pharmacokinetics and pharmacodynamics models, and know-how. They claim that their platform allows them to design both monofunctional and bifunctional degraders. This seems odd since many workers describe the difficulty of designing novel monofunctional degraders and how they are often discovered accidentally. Unless they are developing monofunctional degraders that are not derivatives of thalidomide, it feels like an over-sell.

C4’s targets are good choices for targeted protein degradation but they are not novel. CFT7455 is promising and CFT8634 is going after a very good target. While we like the short term prospects of this company, we are more interested in the long term potential of this technology and companies building tools that give themselves an edge several years from now. Our analysis is that C4’s discovery platform is subpar, the focus on Cereblon (CRBN) is limiting, and developing a potential best in class IMiD instead of a potential first in class combo bifunctional-IMiD is boring. It is difficult to get excited about C4—and by their own admission they are playing it safe by using the same ligase that has given lenalidomide success.

Things to know

The TORPEDO platform is a motif generation model that identifies ideal degrader binding sites on target protein and aids selection of degrader molecule based on a library of available molecules. Below, C4 attempts to illustrate just how big their library of CRBN-binding monofunctional degraders is, with the implication that their library is large enough to allow sampling of the chemical space while applying selection factors towards molecules with higher specificity to protein targets and better drug-like properties (e.g. lower molecular weights, greater polarity, etc.). This does seem to be a unique approach to TPD if for no other reason than it is more focused on avoiding problems with catalytic complexity and poor drug-like-ness that may be a hurdle for competitors that are more focused on novel design and targeting a diversity of ligases.

Currently approved degraders use Cereblon (CBRN) E3 ligases, a ligase present in all organ systems, and C4 has 15 unique CBRN binder motifs, but compared to competitors, this is “all eggs in one basket” in terms of design. This approach also forfeits one of the key purported advantages of TPD technology — that more localized E3 ligases could be employed, avoiding unwanted activity and toxicity elsewhere in the body.

C4 is focused on using CRBN as their main E3 ligase and not that interested on the discovery of new E3 ligases. C4 is an early adopter of the technology and maybe their experience suggests they should not deploy resources to investigate novel E3 ligases. Additionally focusing only on CRBN may simplify computational modeling. Perhaps it does not matter that they are only focusing on CRBN since the discovery of an E3 ligase does not guarantee the discovery of its ligand. It seems odd, since almost every other company is focusing identifying novel ligases. By relying on a ubiquitous E3 ligase these drugs may behave more like traditional small molecules and be less targeted, degrading the POI wherever it finds it. Additionally, this may increase the chance of off-target degradation. With this approach they are missing out on a lot of future potential, especially if E3 ligases become drug targets and emerge as an opportunity to build a moat.

Pipeline

CFT7455

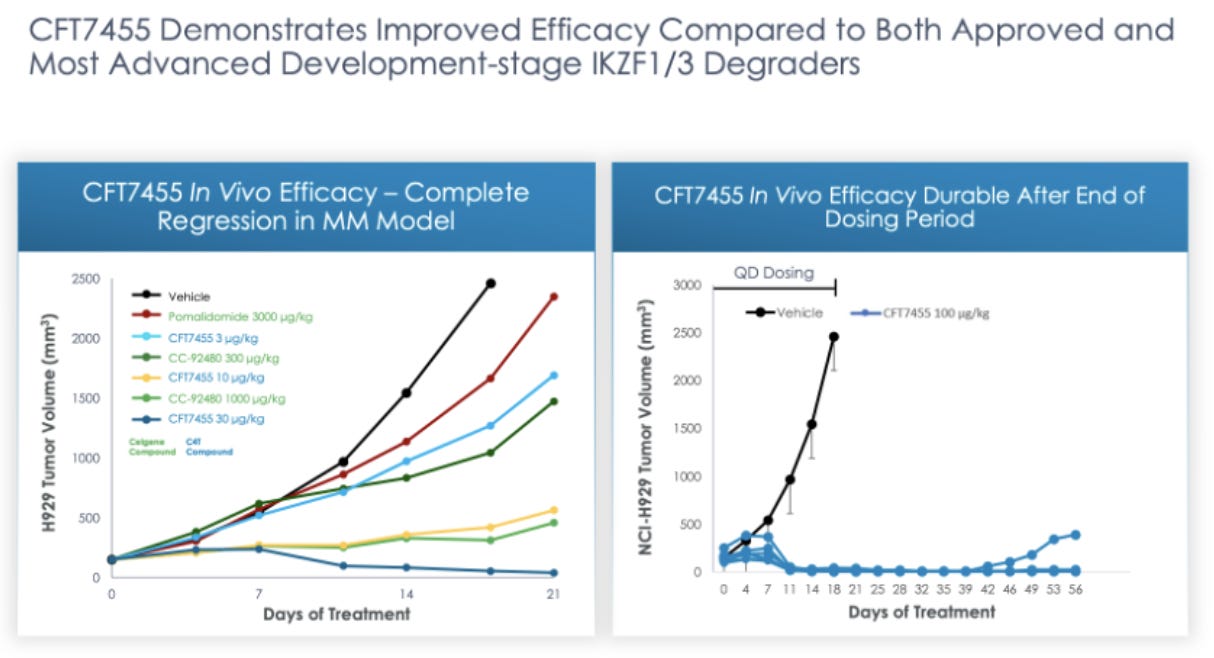

C4’s main asset is CFT7455, a monofunctional degrader of IKZF1/3. This CFT7455 is being marketed as a potential best in class IKZF1/3 degrader. Preclinical data comparing CFT7455 to CC-92480, an IKZF1/3 degrader from Bristol Myers Squibb that is in Phase I trials, and pomalidomide, an FDA approved IKZF1/3 degrader, in a multiple myeloma model shows that CFT7455 is more effective, at significantly lower doses, at reducing tumor volume in murine models.

“We believe our PK/PD models for CFT7455 may be predictive of the target level response as a function of time at a 1 mg / kg oral dose, showcasing the predictive capability of our TORPEDO platform. We observed a similar predictive relationship in a PK/PD model for CFT8634, which is our lead compound of our BRD9 project. As a result of data such as these, we believe our approach maximizes our potential to create effective drugs across many targets.” - C4 Therapeutics

CFT8634

An important asset for C4 is CFT8634, a bifunctional degrader of BRD9 being developed for the treatment of synovial sarcoma (SS). SS is a rare disease with ~900 new cases a year. The median progression free survival for patients given chemotherapy is ~6 months. Workers have shown that BRD9 is essential for the survival of SS cells and that targeted of degradation of BRD9 can reverse oncogenic gene expression. The preclinical data shows CFT8634 is able to degrade BRD9 resulting in a decrease in tumor volume in murine models. BRD9 inhibitors are known, but are not able to effectively disrupt BRD9’s scaffolding functions and can have off target effects like inhibiting BRD4/7. This make BRD9 a good choice to develop degradation. While BRD9 is amplified across numerous cancers, it has been shown to be tumor suppressive in certain contexts, like melanoma. Though the SS indication helps a small patient population is the appealing since relationship of BRD to disease progression is exceedingly clear and there is significant clinical need for a new standard of care. Unfortunately for C4, Foghorn Therapeutics is also in the process of bringing a BRD9 degrader clinic.

CFT8919

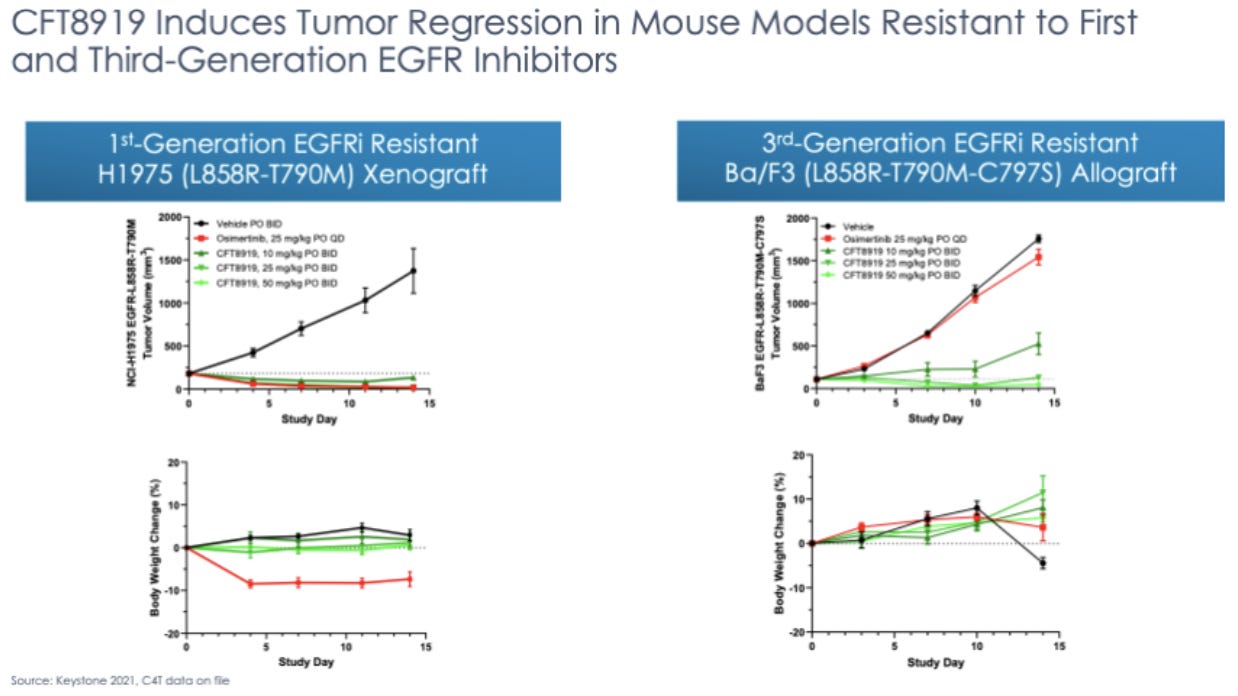

CFT8919 is being developed for the degradation of epidermal growth factor receptor (EGFR) for the treatment of EGFR-mutant non-small cell lung cancer (NSCLC). EGFR, a tyrosine kinase receptor, is a clinically validated target for the indication. The current standard of care relies on small molecule tyrosine kinase inhibitors. Resistance to the current treatment commonly occurs over time, making this a good target for targeted protein degradation since the lower required binding specificity allows for broader targeting of EGFR mutations implicated in disease and less chance that a mutation will meaningfully reduce efficacy. CFT8919 also attaches via an allosteric binding site, meaning that it should interfere less with SMI binding to the active site in hypothetical combo-therapy.

C4’s preclinical data shows that CFT8919 is able to degrade EGFR in human cancer cell lines. As we await human EGFR trial results, there is an area for greater attention: it has been observed that EGFR inhibitors often lead to dermal toxicity. This is something to look out for with CFT8919. The mechanism of action of TPD is unlike that of small molecule inhibitors, so it is possible that this class-specific side effect of EGFR inhibitors is not observed or is less severe. If this is the case, this would be a huge advantage when developing CFT8919.

Catalysts

Meaningful catalysts are likely ~1-1.5 years away, however potential partnerships and announcements of new targets under investigation could serve as catalyst-like milestones in the interim.

CFT7455 Multiple Myeloma | Non-Hodgkin’s Lymphoma https://clinicaltrials.gov/ct2/show/NCT04756726

CFT7455 = Mono-degrader of IKZF1/3

First patient dosed as of June 14, 2021 as part of safety portion

Phase 2 post-safety/dosing stage will not read out preliminary results until 2023 @ the earliest, if successful

If successful can convert into P2 trials in 4 indications (MM mono, MM combo + DMX, MCL, and Peripheral T-Cell Lymphoma)

What we like

Strategy

There is a two-pronged revenue strategy:

Proprietary targets – presumably based on internal IP for identifying meaningful disease targets

Majority of molecules in clinical stage are C4T-only

Early focus on hematological malignancies makes sense strategically as likely to receive FDA fast track designation

Partnerships with pharma to go after specific molecular targets that they have identified. With upfront fees for research & development, milestones, commercialization, royalties

C4 IP is licensed to each partner, exclusive to target

Roche — Deal is multi-target; they make final choices on targets. While Roche walked away from C4’s EGFR molecule, they are still engaged on BRAF clinical-stage target and undisclosed targets

Calico — For aging and cancer targets

Biogen — For CNS disease targets

Current deals could be worth over $2B in milestones if successful

Partnerships more common in current solid cancer indications with greater competitive landscape vs. rare / liquid cancers

Strategic articulation from Cobro fund manager and board chair is very strong, citing opportunity for transformative science but also taking big pharma money early and often. Making friends with in-market manufacturers sets them up to grow large and be buy-out resistant before receiving any approvals on their solely owned products.

Partnerships

C4 and Roche amended their agreement in Nov 2020 to allow the parties to mutually terminate agreements on per-target basis. Roche ended the agreement for CFT8919 but not for their BRAF V600E target. Roche is still developing treatments for lung cancer and invested in another oncology focused targeted protein degradation company, Vividion (now under an acquisition agreement by Bayer), shortly before they exited the EGFR project. Their interest in Vividion may be unrelated to their involvement with C4, however. C4 has also inked deals with Biogen for CNS targets and Google’s secretive biotech company Calico for anti-aging and cancer targets.

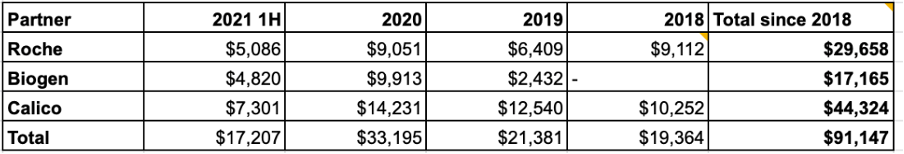

C4 has reported a total of $91M from their partnerships since 2018. Recently this revenue has leveled off with a 4-qtr rolling average of ~$7M per quarter.

Source data from public SEC reports, updated through 2Q 2021

Management

Science muscle from Cambridge, MA club studied disease resistance mechanisms to SOC cancer therapies, concluding that cancer-related proteins ultimately thwart even the most effective cancer therapies in some patients. Protein degraders viewed as tools to use in combination with proven cancer treatments to improve efficacy and durability

They are hiring for a plethora of scientific positions, which indicates they are still developing horsepower on this end to develop their own pipeline/synthesis capabilities or to service their pharma partners

Board chair is co-founder of Cobro Ventures and Dana Farber Innovation Fund - along with a very articulate and well-connected board

High-caliber management team where CEO came from Agios, BIND, Avila (acquired by Celgene), and Biogen and is also on board of Editas

What C4 can work on

Beyond targets that could be more novel and exploratory, our main worry is around their articulation of the platform, where at least they have avoided using the term AI. However, they haven’t spent a lot of time talking in detail about how this platform gives them an advantage for designing binding motifs to target an identified protein target that can be synthesized easily and that have favorable safety profiles.

They are, however great at explaining the rationale of why targeted protein degradation can address existing challenges in disease and linking primary research to clinical findings and back to observed outcomes from SOC treatments. Their avoidance of easy buzzwords and this clear articulation of clinical rationale puts us at lease regarding their black box platform (which may just be TPD expertise).

Risk Reward:

C4’s protein degraders have shown fantastic pre-clinical results but the safety and efficacy of degraders in clinic has not yet been demonstrated, which presents a risk. That being said, due to multiple partnerships with pharma across cancer, CNS and more treatment areas, C4’s revenue and pipeline performance is not tied to a single catalyst, indication area, or partner.

The company is well run and clearly articulates the value that protein degraders can offer both as a monotherapy targeting cancers that are enabled by distinct protein targets as well as in combination with other proven therapies that suffer from disease resistance or reduced efficacy due to the activity of pro-cancer proteins.

C4 has degraders paired with established EGFR, BRAF, and Ret immune checkpoints that can work alongside in-market SOC cancer treatments. As a bonus to this risk/reward balance, C4 currently has 9 undisclosed protein targets in development, which include additional cancer and CNS targets.

While we would like to believe that degrading a single protein can cure MM, we are naturally remaining skeptical. Safety results will be the first to arrive from the recently initiated trial and will be a good indicator of whether researchers are able to reach a dose per kg that matches successful results in pre-clinical studies (30 µg/Kg). At that point if the trial is proceeding we think the bet might be worth it given the scale of the pipeline that backs up their first try, where we are estimating early 2022.

This is a toe-dip at the moment, early trial failures would not be a death blow since they will be followed within 1-2 years with results from trials with big pharma partners, and due to the breadth of the protein degrader pipeline. However, if their Celebron E3 ligase ubiquitination strategy does not work well in the clinic (e.g. due to off-site toxicity) then their whole pipeline could be threatened.

Bull Thesis:

They have a lead on protein degraders in cancer and achieve high efficacy as monotherapy towards specific protein targets (e.g. CFT7455)

Combo efficacy and durability boost leads to rapid approval of degraders developed in partnerships with Roche, Calico, Biogen, or others, delivering multiple streams of milestone and royalty revenue to fund pipeline expansion and investment in non-CRBN mono- or bi-functional degrader technologies

C4's library of lenalidomide-like molecular glues and bifunctional POI-binding domains aims to provide early success targeting well-established cancer targets

C4 is a long way from trial readouts, which are all important to its valuation. However, increasing partnership revenue and new target announcements can provide nearer-term events to maintain value

Management is doing a good job communicating updates and providing additional pre-clinical data and trial design insights to manage investor expectations

Bear Thesis:

Could miss early trial endpoints and be dead in the water

Can’t get its degraders to market fast enough, arrives 2nd or 3rd to market and/or fails to achieve adequate efficacy / safety to become 1L mono/combo in rare indications. With a huge number of competitors likely receiving big pharma funding after P2 the company could miss its window

Most things that target CNS will end up in the graveyard… but it’s an enticing area to pursue given the promise of TPD technology and the huge unmet need (especially for Biogen 😉)

Financial Health

On, June 21, 2021, C4 completed $180M underwriting of public shares, causing drop from $42 to $37 – support persisted at $38, which we view as a plus

$313M in cash-equivalents with a quarterly burn rate of $21M

$CCCC has a 67% float with 48.36M total shares outstanding, of which 54% are held by institutions and 13% held by insiders.

Current short interest is low at 7%

Largest ownership by percentage: Perceptive (7.31%), Blackrock (6%), Cormorant (5.76%), Cobro (5%), RTW (5%), T Rowe Price (5%), Bain (3.8), RA Capital (3.2%), Janus (3%)

Price targets:

$54 - Brookline

$55 - BMO

$63 - HCW

Note: as $CCCC and the rest of TPDs are still in early innings, we will likely update and revisit this company next year after more mature readouts.